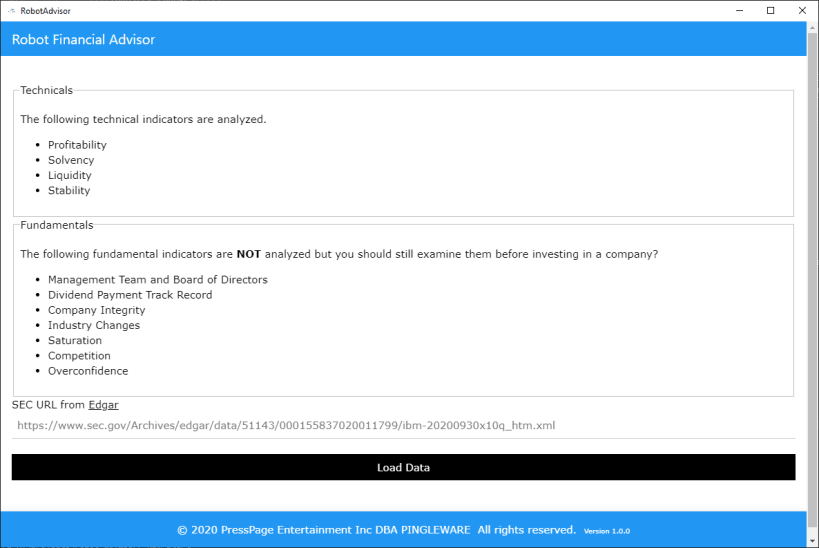

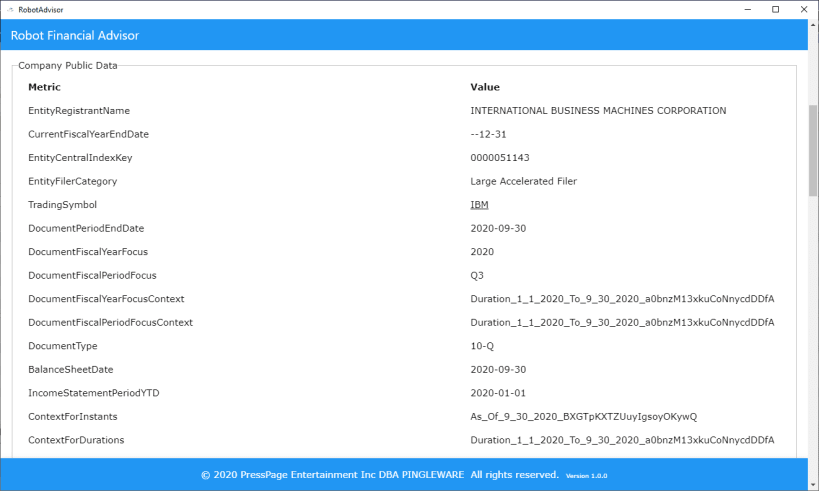

Reads the XBLR instance file from the SEC EDGAR website of public companies to perform an initial analysis. # Technical Elements in Financial Analysis ## Profitability This pertains to the ability of the company to earn income and sustain growth in both the short- and long-term business transactions. Usually, this is based on the income statement which presents the company’s results of operations. The income statement reports the sales, cost of sales, expenses, taxes, insurances, and the net profit of the company. ## Return on Sales The Return on Sales (ROS) ratio tells you how efficiently your company runs its operations. Using the information on your income statement, you can measure how much profit your company produced per dollar of sales and how much extra cash you brought in per sale.

You calculate ROS by dividing net income before taxes by sales. For example, suppose your company had a net income of $4,500 and sales of $18,875. (If your business isn’t a corporation but rather is run by a sole proprietor, you don’t have to factor in any business taxes because only corporations pay income taxes.)

The following shows your calculation of ROS:

Net income before taxes ÷ Sales = Return on Sales

$4,500 ÷ $18,875 = 23.8%

As you can see, your company made 23.8 percent on each dollar of sales. To determine whether that amount calls for celebration, you need to find the ROS ratios for similar businesses. Again, check with your local Chamber of Commerce, or order an industry report online from BizMiner.

This snap hasn't been updated in a while. It might be unmaintained and have stability or security issues.

You are about to open

Do you wish to proceed?

Thank you for your report. Information you provided will help us investigate further.

There was an error while sending your report. Please try again later.

Snaps are applications packaged with all their dependencies to run on all popular Linux distributions from a single build. They update automatically and roll back gracefully.

Snaps are discoverable and installable from the Snap Store, an app store with an audience of millions.

If you’re running Kubuntu 16.04 LTS (Xenial Xerus) or later, including Kubuntu 18.04 LTS (Bionic Beaver) and Kubuntu 18.10 (Cosmic Cuttlefish), you don’t need to do anything. Snap is already installed and ready to go.

Versions of Kubuntu between 14.04 LTS (Trusty Tahr) and 15.10 (Wily Werewolf) don’t include snap by default, but snap can be installed from the command line as follows:

sudo apt update

sudo apt install snapd

To install Robot Financial Advisor, simply use the following command:

sudo snap install robot-advisor

Browse and find snaps from the convenience of your desktop using the snap store snap.

Interested to find out more about snaps? Want to publish your own application? Visit snapcraft.io now.